How a China Economy Collapse Could Impact Global Markets

Do experts think that the China economy collapse? If so, why? And what are the reasons and warning signs that experts are drawing such a conclusion? What impact will this have on the international economy and market? There is a lot of discussion going on about the Chinese economy these days. Because this is the second-largest economy in the world, its collapse will have a harmful impact on the international market.

China Economy Collapse

For several decades, the Chinese economy has been progressing very fast. Due to its rapid progress and excellent growth, the Chinese economy moved from the lower to the upper middle. China achieved this position after facing many challenges.

These are all the challenges and targets that are essential for the economic growth of any country. Like better business policies, well functioning institutions, etc., it should perform its work well. Market oriented policy and rules. Good governance and stability.

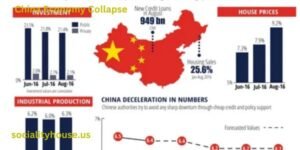

Critics of China’s economic development say that China’s economic collapse is near. They have given some justifications for this, such as China’s progress being based on physical money and real estate, which is run by a failed and weak banking system.

Domestic loans are very high, and they are increasing day by day. The real estate market is sinking, and the labor force is decreasing day by day. Some critics believe that this is the end of the Chinese economy.

Factors Behind China Economy Collapse

There are several factors behind China Economy Collapse which have been discussed below;

a) Real Estate

Real estate was a significant part of the Chinese economy. Still, in 2020, the Chinese government introduced some new policies that encourage more domestic loans.

The real estate business played a major role in China’s economic development. Rather, if understood like this, it bursts like a bubble and becomes a loss.

Property prices in cities were sky-high, and people started investing in real estate. It was a very profitable business, but then some real estate companies faced a shortage of capital, which caused the companies to incur losses and the property business to collapse. Thus, people who had invested in property business incurred huge losses.

The real estate bubble burst with a bang, and the real estate business went into a downfall. A large section of society was dependent on it and everyone’s business went into a ruin.

b) Debt Crisis

In China, the debt burden has reached the highest level. In China, debt has gone beyond limits. By the end of 2023, local government loan was 31 percent of GDP. Apart from this, 13 percent of the loans are separate hidden loans. Thus, the total loan of China is 16 trillion US dollars.

Apart from this, hidden loans, international loans, and household loans are separate.

China’s local government loan is putting pressure on the Chinese economy.

China’s progress is being affected by this, but it has to be said that problems are going to come in the Chinese economy in the future.

China has also made some important policies in this regard, like; To stabilize the local market, the local government has been greatly empowered.

Subsidized houses have been built. In this way, changes in the models of houses which are already being sold, demolition of certain houses which are damaged or not clear and selling of administrative officials are also included.

c) Slowing Economic Growth

In 2020, when the Chinese government brought new development in real estate, the loan taking was limited, due to which some companies had to bear heavy losses. Due to this, people reduced investment in real estate and the real estate business went down.

On the other hand, China has a lot of debts, in which a big part of China’s GDP goes into debts. These are the factors that are affecting China’s development and slowing it.

There used to be a time when China’s rapid development growth was called its rapid development. But now the speed of China’s development has slowed down. According to new reports China’s development growth has come down from double digit to 3-5%.

Due to low speed economy individual’s quantity of purchases decreases, if buy-sell decreases then market will be slow, if market is slow then supply will decrease, if supply decreases then industries and manufacturing will decrease. Labour force will decrease, taxes will decrease and development will decrease.

Apart from this there are some important factors of low development growth like inflation is increasing and individuals are spending less money in markets, similarly there are a lot of aged people in China which means there is a decrease in labour force.

Unemployment is very high in cities. Some political issues also arise. If Donald Trump comes to power again, he can impose more taxes on Chinese exports. In this way, countries that depend on China can face a lot of problems.

d) US-China Trade Tensions

The tension between China and America has put both the super powers under tension. The US government is imposing taxes and other restrictions on Chinese exports which is harming the Chinese economy.

This economic tension between China and America has been going on since January 2018 when President Trump started imposing restrictions and more taxes on Chinese exports. In this way he wants to bring about his desired changes in these trades.

According to the US, all the trade deals with China are unfair, which is causing us a lot of losses and this is increasing the trade deficit between America and China. His intellectualism is going to China. Secondly, the Trump administration says that China should promote its technology, in response to all this, China accused the Trump administration of being extremist.

By 2019, this business tension had reached its peak, but in 2020, both countries signed an agreement. After the end of the Trump government, Joe Biden maintained tariffs and increased taxes on some things, but most of the tariffs were still the same. Now, after Trump returns to power, he can increase his tarrifs by up to 60 percent.

This is the tension due to which industrialists are afraid and are afraid of promoting their businesses. What is going to happen next, due to which the Chinese economy is under negative pressure.

e) Aging Population

The population of retired individuals in China is decreasing very fast and by 2035 it will reach 300 to 400 million which is more than the total population of America.

Because of this, in the 1980s they had a rule under which only one child could be born, due to which their population has decreased a lot before this and will decrease further by 2050.

The biggest loss of this is that there is an increase in old age people in your country and the labour force decreases. These aged people above 60 years get retire and cannot work, but their needs remain the same. Firstly, there is a huge increase in unemployment and dependency, and secondly, they need someone to fulfill the needs of these old people.

Another issue that arises from this is that due to a labor force shortage, people from other areas come and occupy jobs.

f) Banking Sector

The banking system of China is currently in a state of shaded pressure and tension, and the reason for this is the nonactive debt. These are the debts that people have taken loans from them but cannot repay.

If the banking system does not make any proper arrangements for these debts, it will cause a massive loss for them. This will accelerate the collapse of the Chinese economy.

Many of these banks’ properties have been lost in struggling real estate. In this way, questions are being raised on the Chinese banking system as to why, unlike other economies of the world, the banking system is such that it did not make any arrangements for its debt, and the banking system has to collapse.

According to one estimate, the bank’s debt is 40 percent of the total assets of the entire banking system.

g) Currency Depreciation

The Chinese yen is facing a massive decline due to the slowing of the Chinese economy, US-China trade tensions, and the business policies of the State Bank of China. This instability can cause the Chinese yen market to crash. This affects the confidence of investors. If investors lose trust, they can withdraw their money, which is a big loss to the Chinese economy.

This year, the Chinese yen has fallen in comparison to the dollar, Japanese yen, and Korean yen. A little decline is a common occurrence, but there has been a big decline here.

h) Stock Market Volatility

China stock market is famous for its ups and downs. Before this, it has seen many ups and downs. Which causes a lot of loss for traders.

In 2015, China’s stock market has already crashed, which caused a lot of loss to international business. If any other shock comes, it will be a big shock for China.

The up and down in the China stock exchange started in 2021. But the latest data has come in October 2024. According to experts, there can be many ups and downs in the coming days because investors are tolerating all this. But if this situation continues, then there will be problems in the future.

China Economy Collapse Impacts On International Market

Hundreds of companies like Apple, Volkswagen and Burberry depend on Chinese markets and earn a lot of revenue from it. If the Chinese economy collapses, then these companies will be hit hard, and people connected to these companies will also be hit hard.

If the Chinese people make less use of their money and their quality and purchasing power decreases then it will have a very bad impact on the international market, especially on those people who earn from this international market.

According to the experts of China Centre of Oxford University, China has 40 percent share in the international market.

If China develops then it will benefit China itself. Its impact on the rest of the world is less but if the Chinese economy slows down then it causes a lot of damage to the international market. Therefore, for the stability of the international market, the stability of the Chinese economy is also important.

- First of all, international trade will be adversely affected by the collapse of Chinese economy. Those countries which import and export with China will suffer losses.

- There will be a decline in Chinese RMB which will benefit other currencies. If there is a significant increase in the value of other currencies, that will harm the US international market.

- If investors are afraid of China’s slowdown economy, it is also possible that many investors may sell their assets and this can have an impact on the financial market.

- When China’s development growth decreases by 1 percent, global development growth decreases by 0.23 percent.

- China buys most of the raw materials, so if the Chinese economy collapses, there will also be an imbalance at the international level.

- In this way, the expensive brands also have their business in China, and with the collapse of the Chinese economy, these brands will also get a shock.

- In this way, with the slowdown in the Chinese economy, there will also be a big change in the political situation. This is because China is the second superpower at the moment. If the economy collapses there, then another country can take over this place.

- If China wants to develop its natural resource-rich sectors, then it will require more natural resources, which will benefit the countries having natural resources.

Prevention

China’s economy is slowing down, but some experts think it will collapse, and some think it will not; it has just slowed down. However, the Chinese government will have to do something about this slowdown; otherwise, this issue could be raised. China needs some reforms like;

- China needs to support its currently slow economy. It needs reforms like organizing and regulating the property and finance market, eliminating dark spots and shortcomings in it, and making arrangements for the debts taken. There is a need to work on innovations and technologies and reusing energies, solar, and recycling energy resources.

- Another critical issue is that the Chinese economy is highly dependency on the real estate business. No other country depends as much on real estate as China. Therefore, China faces a real estate crisis that has slowed the economy. Thus, this also needs to be managed properly and carefully.

- Another critical issue is China’s exports. China’s exports are enormous, and a good portion of its GDP comes from exports. While this is a good thing, there is also a loss when any country can blackmail your country based on exports, like the Trump administration and the US. So, China should be made to implement this as well.

- China also needs new research and new developments so that it does not get recognized in the competition like electric cars and renewable energy etc.

- China needs major privatization. Industries should be privatized.

- For China, old age people are also a big issue, for this China also needs to work and implement new rules.

- And at the end China also needs new reforms for its international relationships. It needs to improve its relations with other countries. Similarly, for exports, China needs to build relations with various countries so that it does not become dependent on just one person.

FAQs

What are the impacts of China’s economic collapse?

China’s development impacts the international market, but if it collapses, it will have a very bad impact because the Chinese economy accounts for 40 percent of the international market.

Does real estate have a role in the Chinese economy?

Yes, real estate has a significant role in the Chinese economy. After the 2020 reforms, some major construction companies faced financial problems, which caused the real estate business to fall into crisis and slow down the Chinese economy.

What is the role of old people in the collapse of the Chinese economy?

The number of retired people in China is very high, and the reason for this is the rules of the 1980s. Due to these rules, the labor force in China is decreasing, and the population of old and dependent people is increasing.

Conclusion

The collapse of China’s economy is visible, but some experts believe that it is not a collapse but a slowdown. If it is not resolved, then there could be problems in the future. China’s growth has slowed; it is facing a real estate crisis and has enormous debt.

But if work is done carefully and everything is handled correctly, bring positive changes in international relations and find new markets for your exports. Its exports should spread across the world rather than a few specific countries, then it can overcome these challenges. Because China’s development brings some benefits to the international market, but if it collapses, then there will be a big shock to the global market, and many countries will also be affected.

For more interesting, unique, social, and informational, visit our website, socialityhouse.us. Discover more amazing articles that might shock you or, who knows, amaze you. Visit us now. If you have any problem, you can contact us for further information.

Concerns about a potential collapse of China’s economy often center around issues like mounting debt, a slowing property market, and shifting demographics. While China has experienced rapid growth for decades, recent challenges such as declining real estate values, high corporate debt, and population aging could strain its long-term economic stability. However, the government has significant control over key sectors and is known for its ability to implement rapid policy changes, which may help mitigate some of these risks. A full economic collapse remains speculative, but sustained downturns could have global implications due to China’s central role in international trade and supply chains.